Reinforce Your Building: Knowledge in Trust Foundations

Wiki Article

Guarding Your Assets: Depend On Structure Competence within your reaches

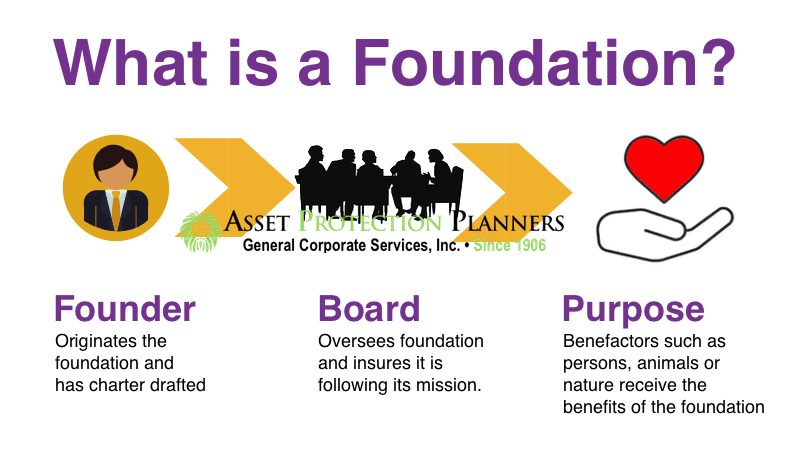

In today's complex monetary landscape, making certain the safety and security and growth of your properties is paramount. Count on structures function as a foundation for guarding your wealth and legacy, supplying an organized strategy to asset protection. Competence in this world can supply vital guidance on navigating legal complexities, taking full advantage of tax obligation performances, and developing a durable economic plan tailored to your distinct requirements. By tapping into this specialized understanding, individuals can not only secure their assets effectively however additionally lay a solid foundation for lasting wealth preservation. As we discover the ins and outs of depend on structure know-how, a globe of possibilities unfolds for strengthening your economic future.Value of Count On Structures

Depend on foundations play a critical function in establishing integrity and promoting solid connections in various expert settings. Structure trust is crucial for companies to prosper, as it forms the basis of effective collaborations and collaborations. When trust is existing, people feel extra confident in their interactions, resulting in increased efficiency and performance. Trust structures act as the cornerstone for honest decision-making and clear communication within companies. By prioritizing trust, businesses can create a favorable job society where workers really feel valued and valued.

Advantages of Expert Support

Structure on the foundation of depend on in specialist relationships, seeking specialist guidance provides indispensable advantages for people and organizations alike. Professional support gives a wealth of understanding and experience that can assist browse intricate financial, lawful, or strategic difficulties easily. By leveraging the expertise of professionals in different fields, individuals and companies can make educated choices that straighten with their goals and ambitions.One substantial advantage of specialist advice is the capacity to accessibility specialized knowledge that might not be conveniently offered or else. Specialists can supply understandings and viewpoints that can cause cutting-edge remedies and possibilities for development. Furthermore, working with experts can help alleviate threats and unpredictabilities by supplying a clear roadmap for success.

Moreover, expert guidance can conserve time and sources by enhancing processes and avoiding costly mistakes. trust foundations. Professionals can offer tailored suggestions tailored to specific demands, making certain that every decision is well-informed and critical. Generally, the advantages of professional assistance are complex, making it a useful asset in safeguarding and making best use of possessions for the long term

Ensuring Financial Protection

In the world of monetary preparation, securing a steady and flourishing future hinges on critical decision-making and prudent investment options. Making certain financial safety includes a complex method that includes numerous aspects of wealth administration. One critical element is creating a diversified financial investment portfolio customized to specific threat tolerance and financial goals. By spreading investments throughout various property courses, such as supplies, bonds, realty, and assets, the threat of substantial financial loss can be mitigated.

Furthermore, preserving a reserve is vital to protect against unanticipated expenditures or earnings interruptions. Experts recommend alloting three to 6 months' well worth of living costs in a liquid, conveniently accessible account. This fund acts as a monetary safeguard, supplying peace of mind during stormy times.

On a regular basis examining and adjusting economic plans in action to transforming scenarios is also extremely important. Life events, market fluctuations, and legal changes can influence financial security, underscoring the relevance of recurring examination and adaptation in the quest of long-term monetary security - trust foundations. By carrying out these strategies attentively and consistently, individuals can strengthen their financial footing and job in the direction of Your Domain Name a more safe and secure future

Protecting Your Possessions Effectively

With a strong structure in place for financial safety and security with diversification and emergency fund maintenance, the following critical action is guarding your properties properly. One reliable strategy is asset allocation, which involves spreading your financial investments throughout different asset classes to lower threat.

Additionally, developing a count on can use a safe and secure method to shield your properties for future generations. Trust funds can aid you control how your properties are dispersed, decrease inheritance tax, and safeguard your wealth from creditors. By implementing these approaches and looking for specialist suggestions, you can guard your possessions properly and protect your monetary future.

Long-Term Possession Protection

To make certain the long-term safety and security of your riches versus potential threats and unpredictabilities in time, tactical preparation for lasting asset security is crucial. Long-lasting property protection involves executing steps to guard your possessions from different dangers such as financial recessions, claims, or unforeseen life events. One critical element of lasting property security is developing a trust, which can supply considerable advantages in protecting your possessions from creditors and lawful disagreements. By moving possession of possessions to a count on, you can safeguard them from potential threats while still retaining some level of control over their administration and distribution.In addition, expanding your financial investment profile is an find out additional key strategy for long-term asset protection. By taking a proactive method to long-lasting possession security, you can protect your riches and offer financial safety and security for yourself and future generations.

Conclusion

In verdict, count on structures play click here for more a vital function in guarding possessions and ensuring monetary safety and security. Professional guidance in developing and taking care of depend on frameworks is necessary for long-term possession defense.Report this wiki page